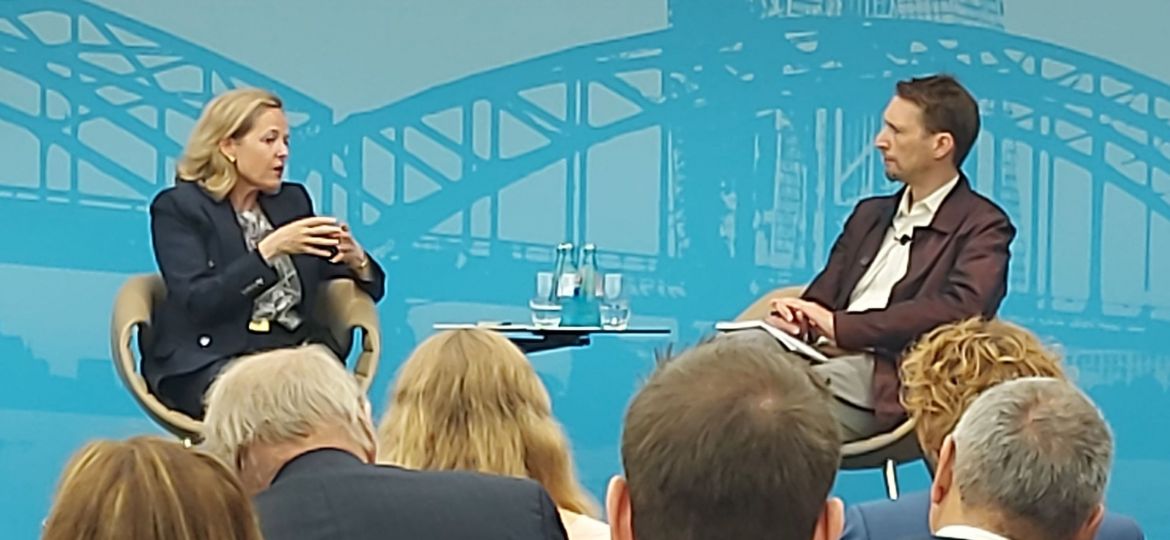

We have launched the 2nd season today! Listen to panel #2 at the “What’s Up Digital Lending?” conference in Frankfurt, Germany, on April 24. A top-class investor round discussing latest trends, risks and returns.

News

Our Annual Report for the year 2023 is out. Full of information on our public affairs and public relations activities, financial accounts and the outlook for the next year. Herewith we meet the requirements of the transparency initiative of Transparency International in which we participate voluntarely.

For the first time, the DLA attended the 'Joint High-Level Conference of the European Commission and the European Central Bank on European Financial Integration' in Frankfurt yesterday. It's a must-attend event for policy makers, regulators, industry leaders, civil society and academics.

We would like to thank all of our 7 founders, our 31 members and the many friends and supporters of our association. We have already had and we will have many great moments in the future. Let's rock the next 5 years together!

The members of our Committee on Legal and European Affairs responded to the German Federal Government's consultation on a draft regulation on Money Laundering Identification by Video Identification.

In cooperation with IHK Berlin and Ostdeutscher Bankenverband we offered a financing workshop for SMEs. We discussed current funding challenges and presented ways to tackle them smoothly.

The 8th Fintech Lending Symposium took place in Dresden on 29th of May 2024. Our Managing Director Constantin Fabricius presented a comparison of Digital Lending models.

Today, we participated in the 'Technical Workshop on Macroprudential Policies for Non-Bank Financial Intermediaries' (NBFI) together with around 100 other stakeholders in Brussels. More than 700 participants attended online. The reason was the consultation assessing the adequacy of macroprudential policies for NBFIs.

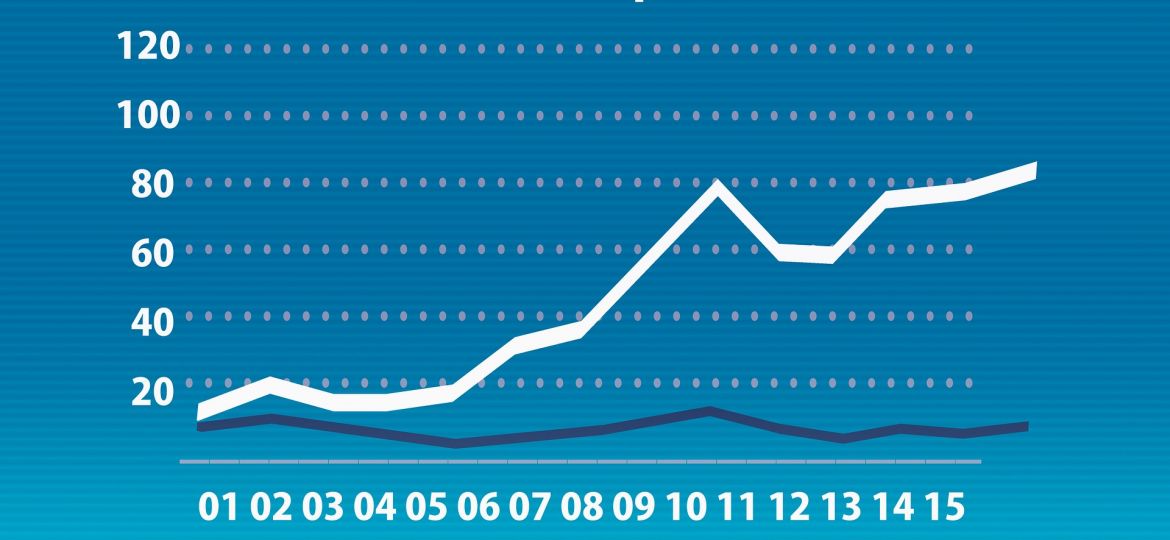

The 2nd Summit took place in Frankfurt on 24th of April. The event, which we organized together with FINFELLAS and Linklaters Germany, was a great success. Digital Lending as an appealing asset class is here to stay and is playing an increasingly important role.

As we continue our journey into 2024, the first quarter has produced a lot of interesting news. It's time to reflect on some of the most important ones and to look at the exciting prospects that lie ahead.